Simple Wealth

With Simple Wealth, you can start with investing a lump sum of at least USD 15,000 and grow your money through Zurich-managed funds. You have the option to add more funds as you go along.

Who is it for?

Who is it for?

Simple Wealth may be suitable for you if:

You've saved some money and are ready to start investing, even if it's totally new to you

Simple Wealth is an excellent choice for new investors due to its lower minimum investment requirement compared to similar market products.

You can accept a certain level of risk for potentially higher returns

Investing in funds carries a degree of risk, and our expert advisers can assist you in determining the level of risk you're comfortable with, and help manage your portfolio.

You can stay invested for at least five years

If you're saving for long-term goals such as buying a house, or your retirement, then Simple Wealth may be suitable for you.

For full details, please refer to the policy terms and conditions.

Who isn’t it for?

Who isn’t it for?

Simple Wealth may not be suitable for you if:

You're a seasoned investor

Simple Wealth primarily offers a range of funds tailored for first-time investors. If you're seeking a more diverse range of investment options, alternative products might be more suitable for your needs.

You're not prepared for funds to lose value

Investment values fluctuate, and if you are uncomfortable with the chance that your investment may be worth less than your initial investment at times, you may want to consider other options.

You prefer regular, fixed, monthly or yearly contributions

If you prefer gradual savings, you might want to choose a plan with flexible deposits instead of a lump sum payment.

Your plan, your way

![]()

Make an initial investment, add more when you can

![]()

Add your partner to the plan

Each individual has distinct aspirations. Our aim is to assist you in saving for your specific goals.

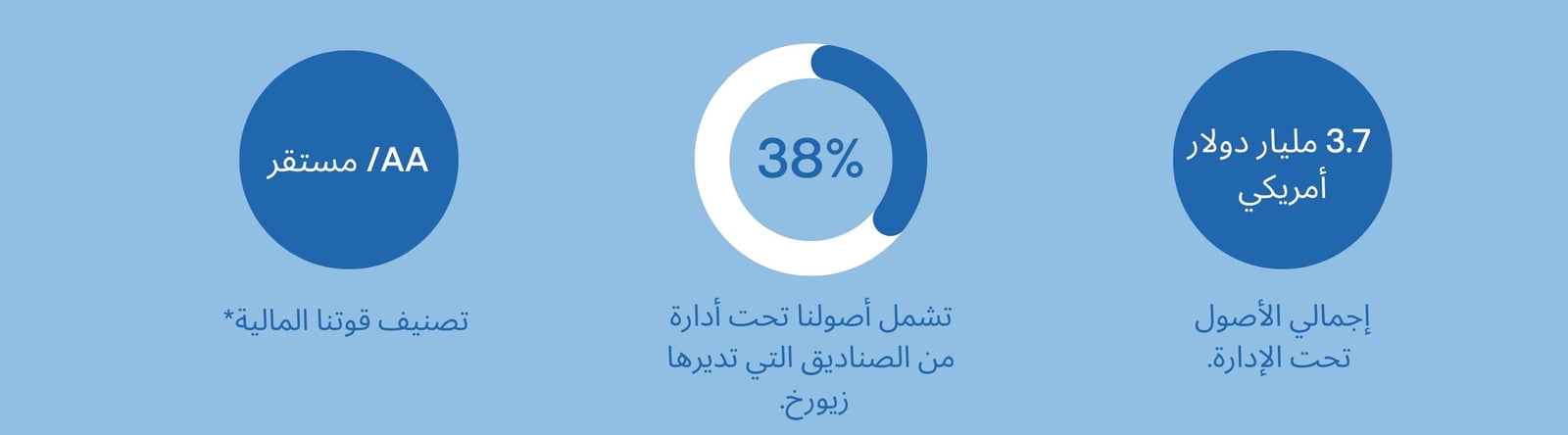

Source: Based on Zurich internal data as of April 2024.

*Standard & Poor’s 2024.

More details

Let’s begin

Leave your contact details and we'll get back to you to book an appointment.